Our Mission

W&W-Strategy

Always on track The W&W share

Everything you need to know about the W&W share, the current share price, the share price performance, our dividend policy and the opinions of analysts.

Share price & basic data

- Security Identification Number (SIN): 805 100

- International Securities Identification Number (ISIN): DE0008051004

- Type of Security: Registered share

- Number of Shares: 93.749.720 shares

- Share Capital: 490,311,035.60 Euro

- Reuters Code: WUWGn.SG

- Bloomberg Code: WUW GR

- Level of transparancy: Prime Standard

- Stock Exchanges:

Regulated Market: Stuttgart, Frankfurt/Main

Open Market: Berlin, Düsseldorf, Hamburg, Hannover, Munich

Successfully invested Main topics at a glance

Reasons to invest in W&W

-

Value-based business model

Our business model is geared towards stability and sustainability. As a service provider, we address the basic needs of our customers around the life topics housing, wealth, security and the future with holistic advice and comprehensive assistance.

Learn more about sustainability at W&W -

Attractive shareholder value

High relevance and demand in the business areas served, together with our low-risk business model, ensure solid key figures, sustainable profits, stable dividends and a promising upside potential for the share.

View annual report of the W&W Group -

High market presence and customer proximity

Large customer potential, sought-after services and a comprehensive sales channel mix, give us access to millions of customers throughout Germany.

Learn more about our corporate structure

Jürgen A. Junker about the W&W Group

„The W&W Group is one of the most efficient and experienced providers of financial planning solutions in Germany.“

Read the full interview

Annual General Meetings

For any details, please refer to our german websites below, as documents will be provided in german only:

Wüstenrot & Württembergische AG Württembergische Lebensversicherung AGAnalyst opinion

Institution |

Published on |

Title |

Target |

|---|---|---|---|

| Montega | 21.08.2025 | W&W legt dank Sachversicherung starkes H1 hin | Buy / Price target: € 21.00 |

| 11.02.2016 | Ersteinschätzung W&W AG | Buy / Price target: € 25.00 | |

| Bankhaus Metzler | 19.08.2024 | Underwriting result stepping further into focus | Buy / Price target: € 18.00 |

| LBBW | 14.08.2025 | Deutlich erhöhtes Halbjahresergebnis | Hold / Price target: € 15.00 |

Numerous analysts follow the development of W&W AG. The list contains banks and securities trading houses which regularly publish commentaries, ratings and recommendations on the share of W&W AG. The list does not claim to be complete. The estimates may be subject to certain assumptions that are not disclosed here.The information is not intended as a recommendation of a financial investment in our company. Any opinions, estimates or forecasts made by these analysts are not opinions, forecasts or predictions of W&W AG or its management. By providing the list, W&W AG does not imply its endorsement of or concurrence with such information, conclusions or recommendations.

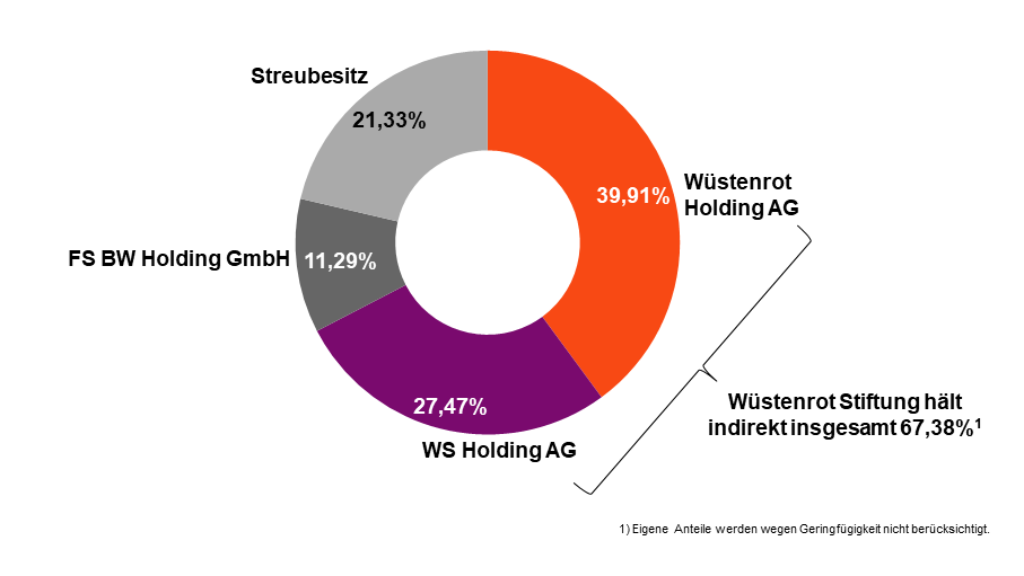

Shareholder structure

Status 30/06/2025

On 1 January 1999, Wüstenrot and Württembergische merged to form Wüstenrot & Württembergische AG (W&W AG). Since then, the registered shares of W&W AG have been officially listed in Stuttgart and Frankfurt.

Via the two holding companies Wüstenrot Holding AG and WS Holding AG, the non-profit

Wüstenrot Stiftung

- Gemeinschaft der Freunde Deutscher Eigenheimverein e.V. (Wüstenrot Foundation) - indirectly holds approx. 67.38% of the shares in Wüstenrot & Württembergische AG.

Both holding companies are solely owned by the Wüstenrot Foundation.

The Wüstenrot foundation works exclusively and directly on a non-profit basis in the areas of monument preservation, science, research, education, art and culture. As an active foundation, it initiates, conceives and implements projects itself and also promotes the implementation of outstanding ideas and projects of other institutions through financial contributions.

For many years, the W&W Group has established an employee share programme with great success. This programme is intended to increase shareholder value orientation among employees, turn employees into co-owners and increase the attractiveness of the W&W Group as an employer. For this employee share programme, W&W buys back shares on the market from time to time and as required.

Learn more (only in German)